Basic approach to corporate governance

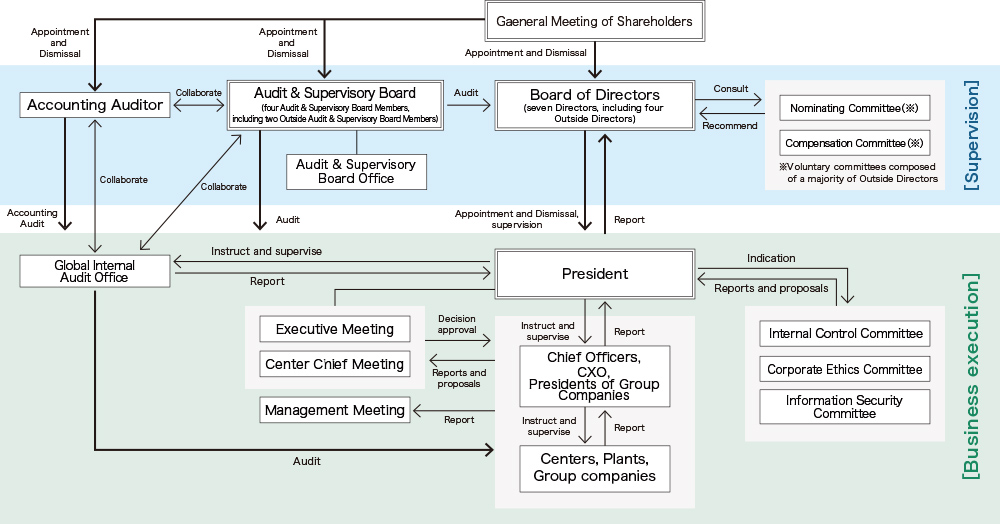

Futaba's corporate governance system emphasizes a balance between supervision by the Board of Directors primarily from on the perspective of Outside Directors, and the capability to execute business operations through the leadership of the President. In order to practice fair and transparent corporate activities in compliance with the letter and spirit of laws and regulations in Japan and abroad, the Board of Directors, the majority of whose members are Outside Directors, supervises business execution and makes important management decisions, with consideration of the allocation of management resources conscious of capital costs, profitability, and growth potential. For business execution, the President provides leadership in formulating and implementing strategic policies, while Center Chiefs and CxOs are responsible for respective functions and in charge of the smooth operation of their organizations.

Through these, the Company organizationally ensures appropriate decision making and strives for sustainable growth and improvement of its corporate value over the medium- to long- term.

Corporate Governance Report

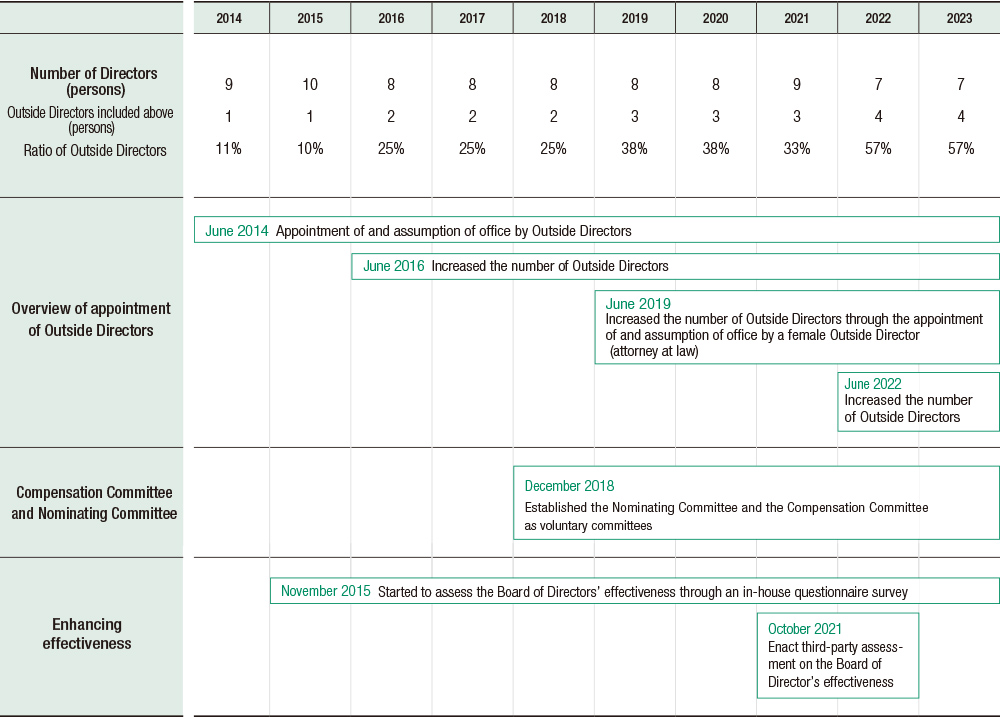

Initiatives for strengthening corporate governance

Corporate governance is a foundation to support our sustainable growth, and we believe it essential to continue to evolve it based on social trends and needs. To strengthen our corporate governance, we have established a rule that requires at least one third of the members of the Board of Directors to be Independent Outside Directors to enable effective oversight of Executive Officers and Directors.

In addition, the effectiveness of the Board of Directors is evaluated annually by a third party organization or the Secretariat of the Board of Directors. The status of operation of the Board of Directors as well as its issues and challenges are surveyed, and response measures are taken in the operation of the Board of Directors in the following fiscal year to achieve continuous improvement.

Promotion system of corporate governance

Our corporate governance promotion structure consists of three major functions.

- 1. Oversight function

- Oversight of business execution by the Board of Directors, Nominating Committee and Compensation Committee, the majority of whose members are Outside Directors

- 2. Business execution function

- The function to execute business under the leadership of the President, comprising deliberative organs to deliberate and resolve issues to be addressed by each center, such as the Executive Meeting, and specialized committees to address corporate issues, such as the Internal Control Committee.

- 3. Auditing function

- Audit of the oversight and business execution functions by internal and external auditing organizations collaborating with each other

(1)Board of Directors

Number of meetings held in FY2023: 13 times

The Board of Directors is composed of seven Directors including four Outside Directors and holds monthly meetings in principle. One of the Outside Directors is female. It discusses statutory and material matters, determines management strategies, and provides oversight of the execution of business operations. In addition to the above members, four Audit & Supervisory Board Members, including two Outside Audit & Supervisory Board Members, attend Board of Directors' meetings. The Board of Directors resolves agenda based on laws, regulations, and the Articles of Incorporation, and discusses important issues relating to the Company's course of action from mid- to long-term and global perspectives.

Main matters discussed at the FY2023 Board of Directors' meetings

| Management strategies |

|

| Policies |

|

| Governance |

|

| Financial results and financial matters |

|

| Personnel |

|

(2)Audit & Supervisory Board

Number of meetings held in FY2023: 13 times

The Audit & Supervisory Board is composed of four Audit & Supervisory Board Members appointed at the general meeting of shareholders (two full-time Audit & Supervisory Board Members and two Outside Audit & Supervisory Board Members) and holds monthly meetings in principle. One of the Outside Audit & Supervisory Board Members is female. The Outside Audit & Supervisory Board Members consist of a certified public accountant, and a member who held directorships and similar positions at other companies. Leveraging their expertise by audit area, they implement operational audits and accounting audits of the Company and its Group companies in Japan and abroad.

Audit structure

The Company undergoes three types of audits: audit by Audit & Supervisory Board Members; internal audit by a unit that directly reports to the President; and audit by the Accounting Auditor that is an audit corporation. With a view to efficient and effective audits, Audit & Supervisory Board Members, the Global Internal Audit Office, and the Accounting Auditor meet at monthly three-way audit meetings and other opportunities to share audit plans and results, and exchange information on risks identified through respective audits. Moreover, to facilitate further information sharing, the Global Internal Audit Office holds a regular monthly meeting with full-time Audit & Supervisory Board Members, who share the information with the rest of the Audit & Supervisory Board.

Audit by Audit & Supervisory Board Members

Audit & Supervisory Board Members audit the status of the establishment and operation of the internal control system, the appropriateness of the methods and results of audits by the Accounting Auditor, and the status of the execution of duties by Directors and other officers, based on the audit policies resolved by the Audit & Supervisory Board, in light also of the company policy and priority issues. Specifically, Audit & Supervisory Board Members attend meetings of the Board of Directors and the Internal Control Committee and other important meetings, receive reports from Directors and other officers on the execution of their duties, and conduct interviews with Group companies in Japan and overseas.

Internal audit

We have the Global Internal Audit Office in place, which is tasked with reporting to the Company's management, including Outside Directors, on the summary of its internal audit results, the urgency of the problems identified, proposed improvements, and other matters in order to provide reasonable assurance regarding the status of auditees. In addition, it offers advice and proposals aimed at strengthening and enhancing the Company's internal control. The Office shares the audit results at Internal Control Committee meetings as well, thereby giving opportunities for individual departments to learn the best practices and issues of other departments and Group companies and to gain insight therefrom.

Audit by Accounting Auditor

PricewaterhouseCoopers Japan LLC has been auditing the Company since FY2019.

(3)Nominating Committee

Number of meetings held in FY2023: Six times

The Nominating Committee consists of five committee members (three Outside Directors, one Inside Director and one member who is not either). The Chairperson is appointed from Outside Directors, with Ms. Motoko Miyajima currently serving in the position. As an advisory body to the Board of Directors, it deliberates matters related to the appointment and dismissal of Directors and Executive Officers from a fair and objective perspective, and submits recommendations to the Board of Directors.

Main matters discussed at the FY2023 Nominating Committee meetings

- Nomination of Director candidates

- Appointment of a Representative Director

- Appointment and dismissal of Executive Officers and Officers

- Assignment of duties to Executive Officers and Officers

- Consideration of succession plans for those officers including the President

(4)Compensation Committee

Number of meetings held in FY2023: Seven times

The Compensation Committee consists of five committee members (three Outside Directors, one Inside Director and one member who is not either). The Chairperson is appointed from Outside Directors, with Mr. Masayoshi Ichikawa currently serving in the position. As an advisory body to the Board of Directors, it deliberates the compensation system and standard, and the amount of compensation of Directors, Executive Officers, and others from a fair and objective perspective, and submits recommendations to the Board of Directors.

Main matters discussed at the FY2023 Compensation Committee meetings

- Monthly compensation for Directors, Executive Officers, and Officers

- Amounts of Bonuses for Directors, Executive Officers, and Officers

- Restricted stock compensation for Directors, Executive Officers, and Officers

- A vision for the compensation system for Directors, Executive Officers, and Officers

(5)Executive Meeting

Frequency of meetings: Once a month in principle

The meeting is composed of the President and Executives, and deliberates and resolves highly confidential matters among items for decision-making regarding business execution.

(6)Center Chief Meeting

Frequency of meetings: Once a month in principle

The meeting is composed of the President, Center Chiefs, and full-time Audit & Supervisory Board Members, and deliberates and resolves matters to be submitted to the Board of Directors, other important matters, and individual issues.

Approach to internal control

We perform business operations properly across the Group, based on our Purpose, Mission and Values, the FUTABA WAY, and the Charter of Corporate Behavior, and FUTABA Code of Conduct. We strive to improve the quality of our operation, and the quality of corporate management in the long run, through initiatives centering around the following items, repeating maintenance and improvement through TQM activities. We also aim to sustainably improve the corporate value toward the SDGs goals.

- a.Establish the mechanism of operation, incorporating the way of thinking of "division of roles among business practice, guidance and check, and audit (three lines of function) in response to risks"

- b.Clarify roles and responsibilities regarding duties in the Group, and make subsidiaries autonomous

- c.Improve education system on TQM activities and operation standards, and raise the level of the entire organization

Through these initiatives, we will realize the internal control we pursue by increasing human resources equipped with high ethical standard and establishing an effective organization.

Internal control system

We share with Directors and other Officers responsible for business execution the attitude expected in performing business operations properly in accordance with the Companies Act and other laws and regulations. Matters to be submitted in accordance with the rules are discussed thoroughly at the Board of Directors meetings and others, and executed after proper decision making.

In actual business operations, the Internal Control Committee promotes the internal control activities within the Company as an advisory body to the Board of Directors. In addition, we have established the Working-level Meeting on Internal Control under the Internal Control Committee to promote the practical aspects of internal control. The Internal Control Committee has set the FUTABA Management Standard as the benchmark of management standard and good quality requirement, and divisions in the headquarters promote the improvement activities of operational quality as the promotor of our global organization. We aim to improve the corporate management quality through the improvement activities of operational quality, and as a result, to secure the internal control of our global organization.

Status of the activities of the Internal Control Committee are reported regularly to the Board of Directors. The global progress of the improvement activities of operational quality is considered when determining the direction of activities, in addition to the advice received from the Board members by sharing issues identified at each region and site.

Criteria for appointment and dismissal of Directors and

Audit & Supervisory Board Members

The Board of Directors emphasizes the balance of skills, experience, and expertise as well as diversity and suitability of Directors in their appointment, dismissal and nomination, in order to ensure the function of the Board of Directors and to make accurate and swift decisions. The Nominating Committee was voluntarily established in December 2018, as an advisory body to the Board of Directors chiefly composed of Independent Outside Directors. In case of appointment, dismissal, and nomination of Directors, the Board of Directors receives recommendations with reasons for individual appointment, dismissal, and nomination from the Nominating Committee, and then decides at Board of Directors meetings. Starting from the general meeting of shareholders in 2019, the Committee's input has been reflected in the proposals for appointment, dismissal, and nomination of Directors.

In case of the appointment and dismissal of Audit & Supervisory Board Members, we appoint persons who can contribute to appropriate management audit with the knowledge of business management, finance, and accounting. The Board of Directors obtains the consent of the Audit & Supervisory Board via the latter's resolution, whereupon it decides on the candidates and submits proposals for appointments of Audit & Supervisory Board Members to the general meeting of shareholders.

Directors and Audit & Supervisory Board Members skills matrix

The competencies and experience of the Company's Directors and Audit & Supervisory Board Members are as follows.

| Corporate management and governance | Technology and development | Production engineering, manufacturing, and quality | Sales and purchasing | Finance and accounting | Compliance and risk management | Sustainability | IT and DX | Overseas business | |||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Human capital | Environment | ||||||||||

| Representative Director and President | Yoshihiro Uozumi | ○ | ○ | ○ | ○ | ○ | ○ | ||||

| Representative Director | Toshio Yokota | ○ | ○ | ○ | ○ | ○ | ○ | ||||

| Director | Hideki Imai | ○ | ○ | ○ | |||||||

| Outside Director | Masayoshi Ichikawa | ○ | ○ | ○ | ○ | ||||||

| Outside Director | Motoko Miyajima | ○ | ○ | ○ | |||||||

| Outside Director | Yoshihisa Miyabe | ○ | ○ | ○ | ○ | ||||||

| Outside Director | Hideo Yamamoto | ○ | ○ | ○ | ○ | ○ | ○ | ||||

| Full-time Audit & Supervisory Board Member |

Kazunori Kato | ○ | ○ | ○ | |||||||

| Full-time Audit & Supervisory Board Member |

Keiichi Toriyama | ○ | ○ | ○ | |||||||

| Outside Audit & Supervisory Board Member |

Shigeo Hayashi | ○ | ○ | ○ | ○ | ○ | |||||

| Outside Audit & Supervisory Board Member |

Yumiko Sakurai | ○ | ○ | ||||||||

Criteria for appointment of Independent Officers

We appoint Independent Officers in accordance with the criteria for externality as defined in the Companies Act and the criteria for independence as defined by the financial instruments exchange. In case of appointment, we place importance on a high level of expertise and wealth of experience that enable candid and constructive advice and supervision to management.

Reasons for appointment of Outside Directors and

Outside Audit & Supervisory Board Members

The Company appoints four Outside Directors and two Outside Audit & Supervisory Board Members to receive advice and suggestions from an external viewpoint to ensure appropriate decision making by the Board of Directors, in addition to benefitting from their fields of expertise.

Main reasons for appointment of Outside Directors and Outside Audit & Supervisory Board Members

| Name | Position | Independent Officer | Main reasons for appointment | Attendance in FY 2023 | |||

|---|---|---|---|---|---|---|---|

| Board of Directors | Nominating Committee | Compensation Committee | Audit & Supervisory Board | ||||

| Masayoshi Ichikawa | Outside Director | ○ | Mr. Masayoshi Ichikawa has many years of experience as corporate manager at Toyoda Gosei Co., Ltd. His appointment will bring his wealth of experience and deep insight into the Company's management. | 13/13 (100%) |

6/6 (100%) |

7/7 (100%) |

― |

| Motoko Miyajima | Outside Director | ○ | Ms. Motoko Miyajima has expertise and experience acquired over many years as an attorney at law. Her appointment will bring her wealth of experience and deep insight into the Company's management. | 13/13 (100%) |

6/6 (100%) |

7/7 (100%) |

― |

| Yoshihisa Miyabe | Outside Director | Mr. Yoshihisa Miyabe has expertise and experience relating to production engineering divisions acquired over many years at Toyota Motor Corporation. His appointment will bring his wealth of experience and deep insight into the Company's management. | 13/13 (100%) |

― | ― | ― | |

| Hideo Yamamoto | Outside Director | ○ | Mr. Hideo Yamamoto has many years of overseas experience at MUFG Bank, Ltd. and a wide range of knowledge of finance, as well as knowledge of the finance and information systems divisions and experience in management as a director at KOITO MANUFACTURING CO., LTD. His appointment will bring his wealth of experience and deep insight into the Company's management. | ― | ― | ― | ― |

| Shigeo Hayashi | Outside Audit & Supervisory Board Member | ○ | In addition to his experience as Director and Senior Managing Executive Officer at Olympus Corporation, Mr. Shigeo Hayashi also has experience from serving mainly in that company's Production Engineering Division. His appointment will bring his wealth of experience and deep insight into the Company's audit. | 13/13 (100%) |

― | ― | 13/13 (100%) |

| Yumiko Sakurai | Outside Audit & Supervisory Board Member | ○ | Ms. Yumiko Sakurai has expertise and experience acquired over many years as a certified public accountant as well as experience as an outside officer of other companies. Her appointment will bring her wealth of experience and deep insight into the Company's audit. | ― | ― | ― | ― |

- * Director Hideo Yamamoto was nominated as an Director at the 110th Ordinary General Meeting of Shareholders, held on June 21, 2024.

- * Audit & Supervisory Board member Yumiko Sakurai was nominated as an Audit & Supervisory Board member at the 110th Ordinary General Meeting of Shareholders, held on June 21, 2024.

Sharing of information with Outside Directors and Outside Audit & Supervisory Board Members

In order to deepen the understanding of Outside Directors and Outside Audit & Supervisory Board Members on our business execution, we have each division submit reports and hold plant tours of the Company and subsidiaries for them, in addition to holding a preliminary briefing on matters to be submitted to the Board of Directors.

For Outside Audit & Supervisory Board Members, we have set up Audit & Supervisory Board Office as an organization to support the auditor's duties and assigned dedicated staff members.

Training for Directors and Audit & Supervisory Board Members

For Directors and Audit & Supervisory Board Members who play key roles in the important governance system, we hold seminars on laws and regulations related to corporate officers, in order to deepen their understanding on their roles and duties. Furthermore, we provide regular training session for Directors and Audit & Supervisory Board Members focusing on medium- to long-term issues, while arranging their participation in outside seminars and inviting outside professionals to workshops as necessary.

Compensation for Directors and Audit & Supervisory Board Members

Basic approach

Compensation for Directors is set at the level competitive enough to secure and retain talented persons to realize the Management Principle as well as to motivate them to fulfil expected roles toward the sustainable improvement of corporate value and shareholders' value. Specifically, compensation for Directors who assume business execution is composed of monthly compensation, bonuses, and stock compensation. Compensation for Outside Directors who assume oversight function is composed of monthly compensation only. Regarding the content of compensation for Directors, we ensure rationality, objectivity, and transparency in both of the content and the decision procedure, in order to fulfil accountability to shareholders and other stakeholders.

Calculation method

| Type of compensation | Monthly compensation | Bonus | Stock compensation |

|---|---|---|---|

| Ratio | 60% | 30% | 10% |

| Eligible position | Directors, Audit & Supervisory Board Members | Directors (excluding Outside Directors) |

Directors (excluding Outside Directors) |

| Calculation method | The amount is determined according to positions and responsibilities, etc., and reviewed as appropriate to be competitive enough to secure and retain talented persons in the job market, in view of our corporate performance, standards of other companies, and social environments. | The amount is calculated by the Board of Directors in view of consolidated operating profit of each fiscal year, the level of achievement of targets determined in the medium- term management plan, and the level of achievement of targets for environmental issues, and the amount and the timing of payment are determined by the resolution of the annual general meeting of shareholders. | In order to share values with shareholders and drive the motivation to contribute to enhancing the medium- to long-term corporate value and shareholders' value, the Company allocates restricted stocks to a Director responsible for business execution with restriction on transfer until the Director retires from the position in principle as a reward for business execution every fiscal year, and grants monetary claims to be used for payment in exchange for allocated stock at a certain period every fiscal year. The number of shares to be allocated is determined in view of positions, responsibilities, share price, etc. |

Method for determining the amount of compensation for Directors and Audit & Supervisory Board Members

Matters regarding individual Directors' monthly compensation are ent rusted f rom the Board of Directors to the Representative Director on the condition that they will be decided by the voluntary Compensation Committee, majority of whose members are Independent Outside Directors.

Subject to the approval of a general meeting of shareholders on the total amount of Directors' Bonus, the Board of Directors entrusts matters regarding individual Directors' bonuses to the Representative Directors on the condition that they will be decided by the voluntary Compensation Committee.

The Representative Directors later report to the Compensation Committee on the actual monthly compensation and bonus payments made to individual Directors to make sure that those correspond to the Compensation Committee's approval.

For stock compensation for Directors, the number of shares to be allocated to individual persons is determined by the resolution of the Board of Directors, taking into account the deliberation and recommendation of the Voluntary Compensation Committee. Compensation for Audit & Supervisory Board Members is determined through consultation among them.

Amount of compensation for Directors and Audit & Supervisory Board Members

| Category | Total amount of compensation (million yen) |

Total amount of compensation by type(million yen) | Number of Directors/ Audit & Supervisory Board Members eligible for payment (persons) |

||

|---|---|---|---|---|---|

| Monthly compensation | Bonus | Stock compensation | |||

| Directors (excluding Outside Directors) |

118 | 79 | 30 | 8 | 4 |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

27 | 27 | ― | ― | 2 |

| Outside Director | 23 | 23 | ― | ― | 4 |

| Outside Audit & Supervisory Board Member | 15 | 15 | ― | ― | 3 |

*The figures above include one Director and one Outside Audit & Supervisory Board Member who stepped down at the close of the 109th Annual General Meeting of Shareholders held on June 22, 2023.

Assessment of the Board of Directors' effectiveness

We aim for continuous improvement of the Board of Directors, by conducting questionnaire surveys yearly to Directors and Audit & Supervisory Board Members and analyzing them to see whether the Board of Directors is effectively fulfilling its roles and duties. A summary of the Board of Directors' effectiveness assessment in FY2023 and the results are shown below. Based on the survey results, effectiveness improvement actions planned for FY2024 were submitted to the Board of Directors in February 2024.

Survey target: All Directors (seven persons) and Audit & Supervisory Board Members (four persons)

Assessment method: A questionnaire survey was conducted with the target respondents.

Assessment items: a total of 31 questions about the Board of Directors' composition, operation, discussions, monitoring functions, and other items

| Issues identified in FY2022 | Actions taken in FY2023 | |

|---|---|---|

| Operation of the Board of Directors | Increase participants' understanding of the matters submitted to the Board of Directors' meeting |

|

| Discussions at Board of Directors meetings | Deepen discussions on topics that need to be discussed more deeply | Discussions broadened and deepened on topics such as human capital, development of successors to top management, and improvement of corporate value |

Overall results of FY2023 assessment

- Scores were generally high for all the items surveyed. This has led us to conclude that the Company's Board of Directors functions effectively.

- The measures introduced in FY2022 to improve the Board of Directors' operation and discussions have invigorated debate on important management issues.

- Given that new issues were identified, however, further actions are needed to enhance the Board of Directors' effectiveness.

| Issues identified in FY2023 | Actions being taken | |

|---|---|---|

| Operation of the Board of Directors | Provide Outside Directors and Outside Audit & Supervisory Board Members with enough time to consider and review the matters submitted | A timetable is drawn up to schedule preparation tasks for each Board of Directors meeting to allow Outside Directors and Outside Audit & Supervisory Board Members enough time to consider and review the matters submitted (action underway since FY2022). |

| Discussions at Board of Directors meetings |

Discuss even broader issues including the following:

|

|